As a trusted advisor to your small business clients, you play a crucial role in helping them make smart financial decisions—including how they offer health benefits. Many employers aren’t aware that modern options like Individual Coverage HRAs (ICHRAs) and Qualified Small Employer HRAs (QSEHRAs) can provide a tax-efficient, compliant way to support their team’s healthcare needs. This guide walks you through how these tools work—so you can help your clients reduce costs, stay compliant, and offer meaningful benefits.

ICHRA Learning Center: Your Complete Guide to Individual Coverage HRAs

Explore our comprehensive ICHRA Learning Center. Get answers to your ICHRA questions, watch videos, and access resources to simplify your health benefits.

subtopics

QSEHRA Learning Center: Your Complete Guide to QSEHRAs

Explore our QSEHRA Learning Center. Get answers to your questions, watch videos, and access resources to simplify your small business health benefits.

subtopics

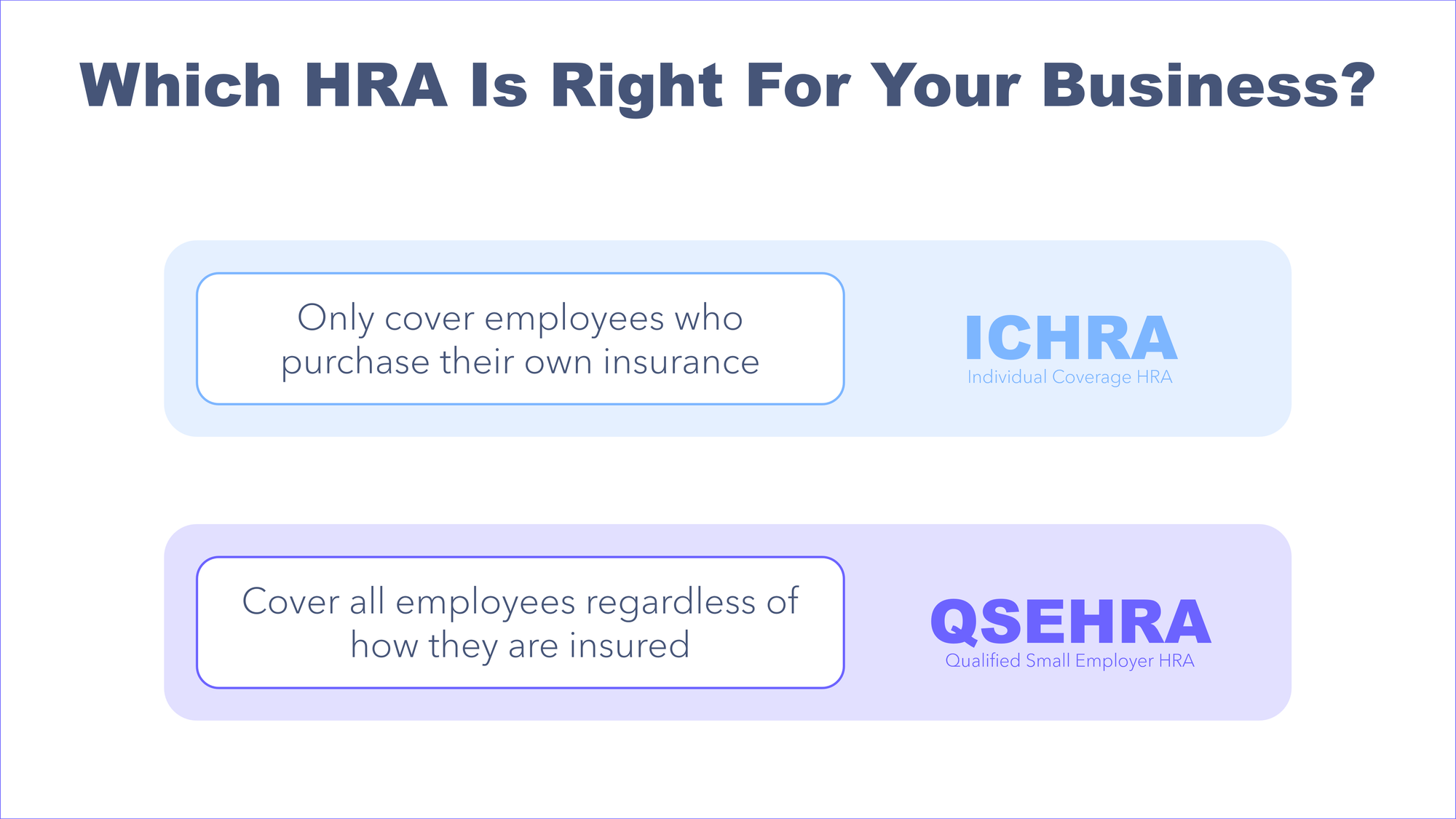

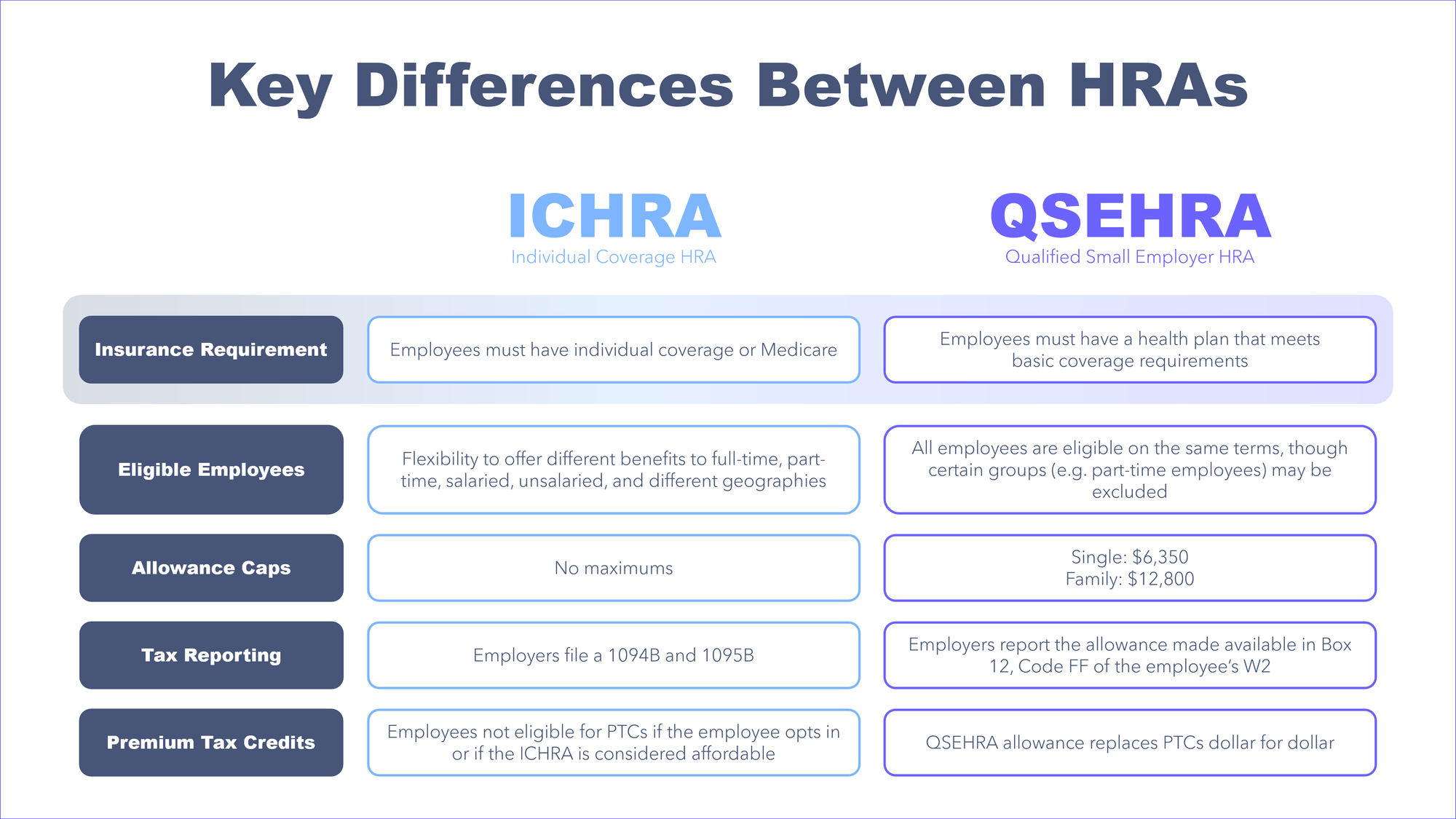

ICHRA vs QSEHRA: Which HRA Is Right for Your Business?

Compare ICHRA and QSEHRA plans to determine which HRA is best for your business based on coverage needs, flexibility, and reimbursement structure.

subtopics

Avoid Legal Pitfalls: Reimburse Employees with ICHRAs & QSEHRAs

Avoid costly ACA violations. Learn why direct health reimbursements are risky—and how to stay compliant with QSEHRAs or ICHRAs

subtopics