Does This Pertain to You?

If you administer a QSEHRA, ICHRA, or GCHRA (EBHRAs are exempt) with any plan year ending in 2024, you must file Form 720 (Quarterly Federal Excise Tax Return) and pay the PCOR fee (Patient‐Centered Outcomes Research Trust Fund) by July 31, 2025.

What To Do

Download Form 720

- Get the latest second-quarter Form 720 (June 2025 revision) here:

Form 720 (Quarterly Federal Excise Tax Return)

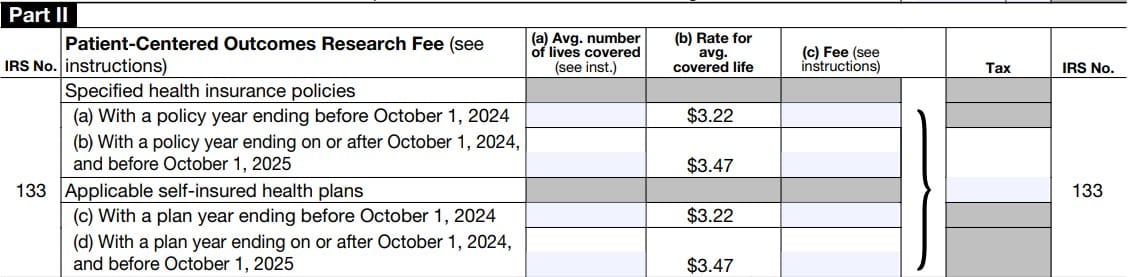

Select the Correct Rate

- Row (c): Plan year ending Jan 1 – Sep 30, 2024 → $3.22 per covered life

- Row (d): Plan year ending Oct 1 – Dec 31, 2024 → $3.47 per covered life

Calculate Your Average Covered Lives

Use the Actual Count Method:

- Add the total number of lives covered on each day of your plan year, then divide by the number of days in that plan year.

- Example: 36,500 daily lives ÷ 365 days = 100 average covered lives.

Complete Form 720

- Enter your average lives in Column (a), using the appropriate Row.

- Multiply Column (a) by Column (b), to calculate your fee in Column (c).

Submit Your Payment

- Include the payment voucher Form 720-V with Form 720 and a check or money order payable to

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

ICHRA Learning Center: Your Complete Guide to Individual Coverage HRAs

Explore our comprehensive ICHRA Learning Center. Get answers to your ICHRA questions, watch videos, and access resources to simplify your health benefits.

subtopic

QSEHRA Learning Center: Your Complete Guide to QSEHRAs

Explore our QSEHRA Learning Center. Get answers to your questions, watch videos, and access resources to simplify your small business health benefits.

subtopic