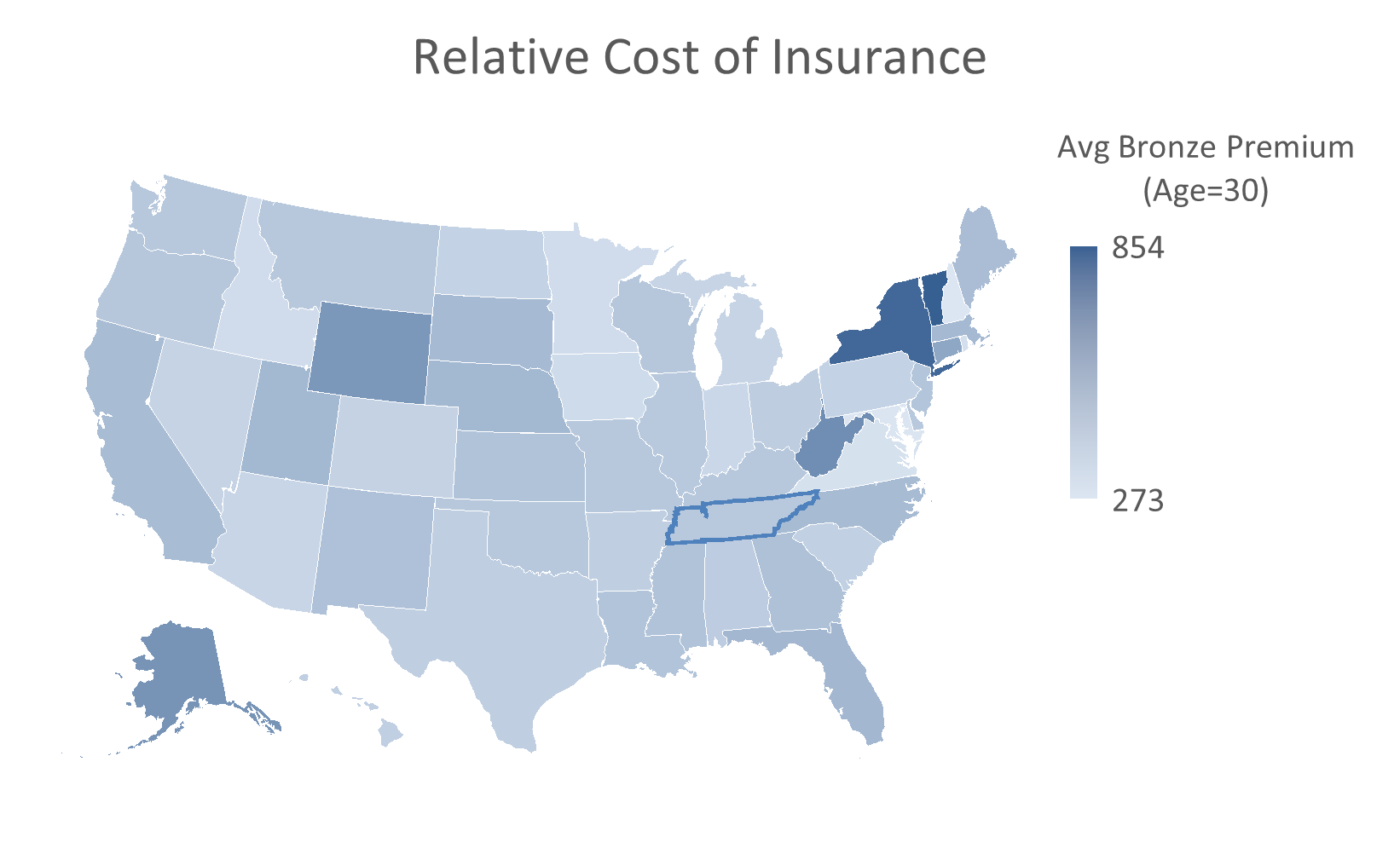

Relative Cost of Coverage

At $398 per month, Tennessee’s average Bronze premium is the 21st lowest among the 50 states—above New Hampshire (the least-expensive state with an average premium of $273) and below Vermont (the most-expensive state with an average premium of $854).

Because Tennessee’s average premiums are lower than the U.S. average and incomes are lower than the U.S. median, the premium represents 6.6% of median household income—close to the national average of 6.3%.

| Avg Premium | Premium / Household Income | |

| Tennessee | $398 | 6.6% |

| United States | $425 | 6.3% |

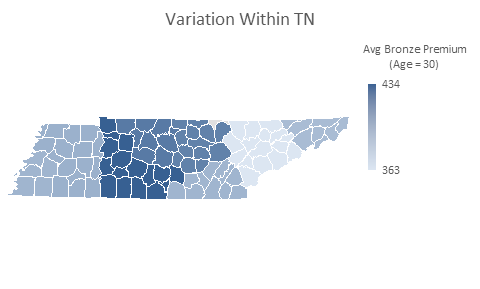

Variation Within the State

Within Tennessee, Bronze premiums for a 30-year-old range from about $363 to $434—an approximate 1.2-to-1 swing.

| Tennessee’s Population Pct | Below this Average Premium | Counties |

| 25% | $385 | Sullivan |

| 50% | $389 | Washington |

| 75% | $420 | Putnam, Cumberland |

- One-quarter of Tennessee residents live in areas where the average 30-year-old Bronze plan is $385 or less, and three-quarters live where it’s $420 or less.

- The lowest average Bronze premiums for 30-year-olds are typically found in counties such as Anderson County ($363), Union County ($363), and Sevier County ($363), all clustered in eastern Tennessee.

- Conversely, the highest average premiums are often seen in counties like Coffee County ($434), Maury County ($434), and Wayne County ($434), largely across Middle and southern parts of the state.

- In Shelby County, the state’s most populous county, the average Bronze premium for a 30-year-old is $389.

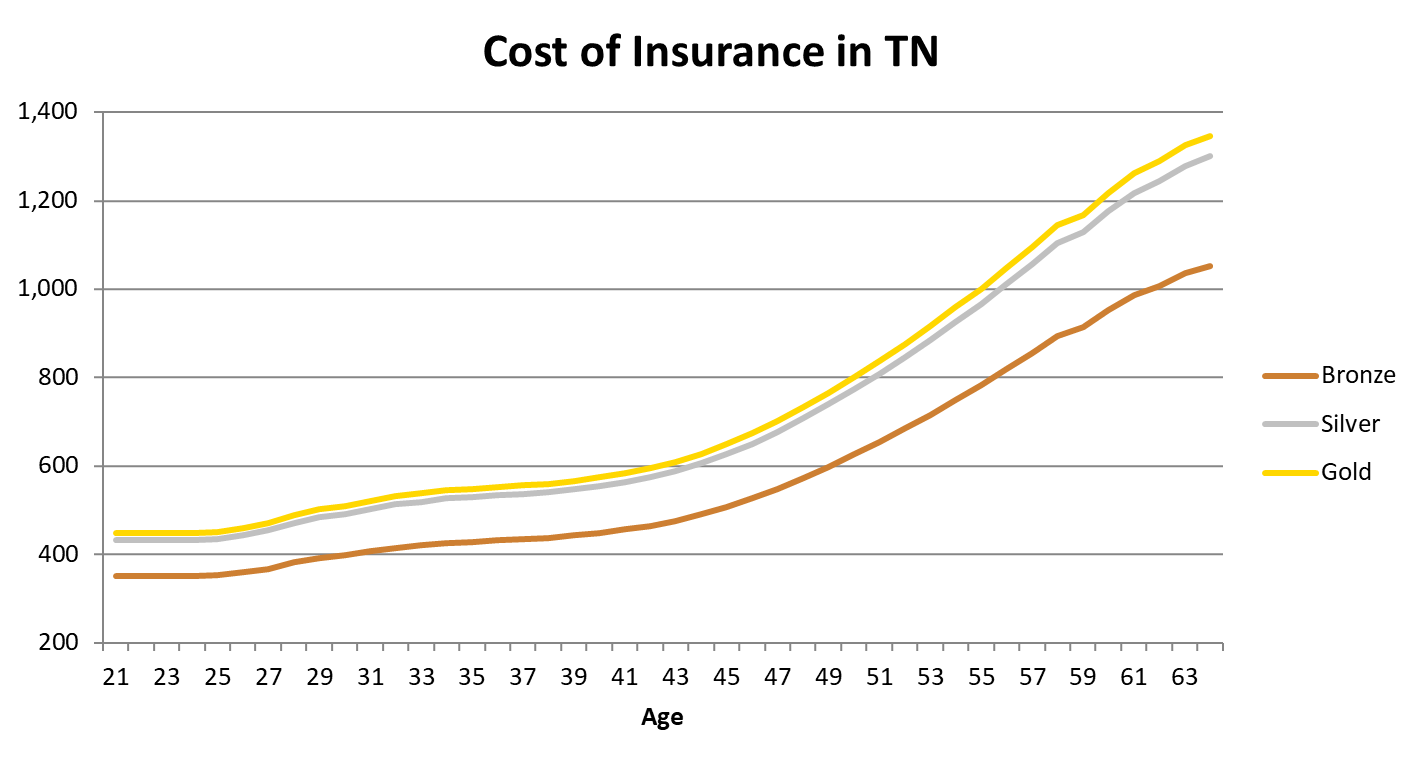

Variation by Age

| Age | Average Bronze | Average Silver | Average Gold |

| 21 | $351 | $433 | $449 |

| 30 | $398 | $492 | $509 |

| 40 | $448 | $554 | $574 |

| 50 | $626 | $774 | $802 |

| 60 | $952 | $1,176 | $1,218 |

Average premiums for Bronze plans rise by approximately $5 per year from age 21 to 30. Through the 30s, this increases to about $5 per year. The pace quickens in the 40s, with an average annual increase of roughly $18, and then surges to approximately $33 per year for those in their 50s. It’s a classic “hockey-stick” curve once you hit midlife. Silver and Gold plans follow a similar trajectory, consistently costing about 24% and 28% more than Bronze plans, respectively, at each age band.

The Role of Premium Tax Credits

Premium Tax Credits (PTCs) limit the share of household income that is spent on a marketplace plan.

They equal the difference between (a) the premium of the benchmark Silver plan for an employee’s age and county and (b) a sliding-scale contribution tied to household income. Because benchmark premiums rise with age, PTCs rise more or less in step; because the required contribution shrinks as income falls, credits grow even faster for lower-paid workers.

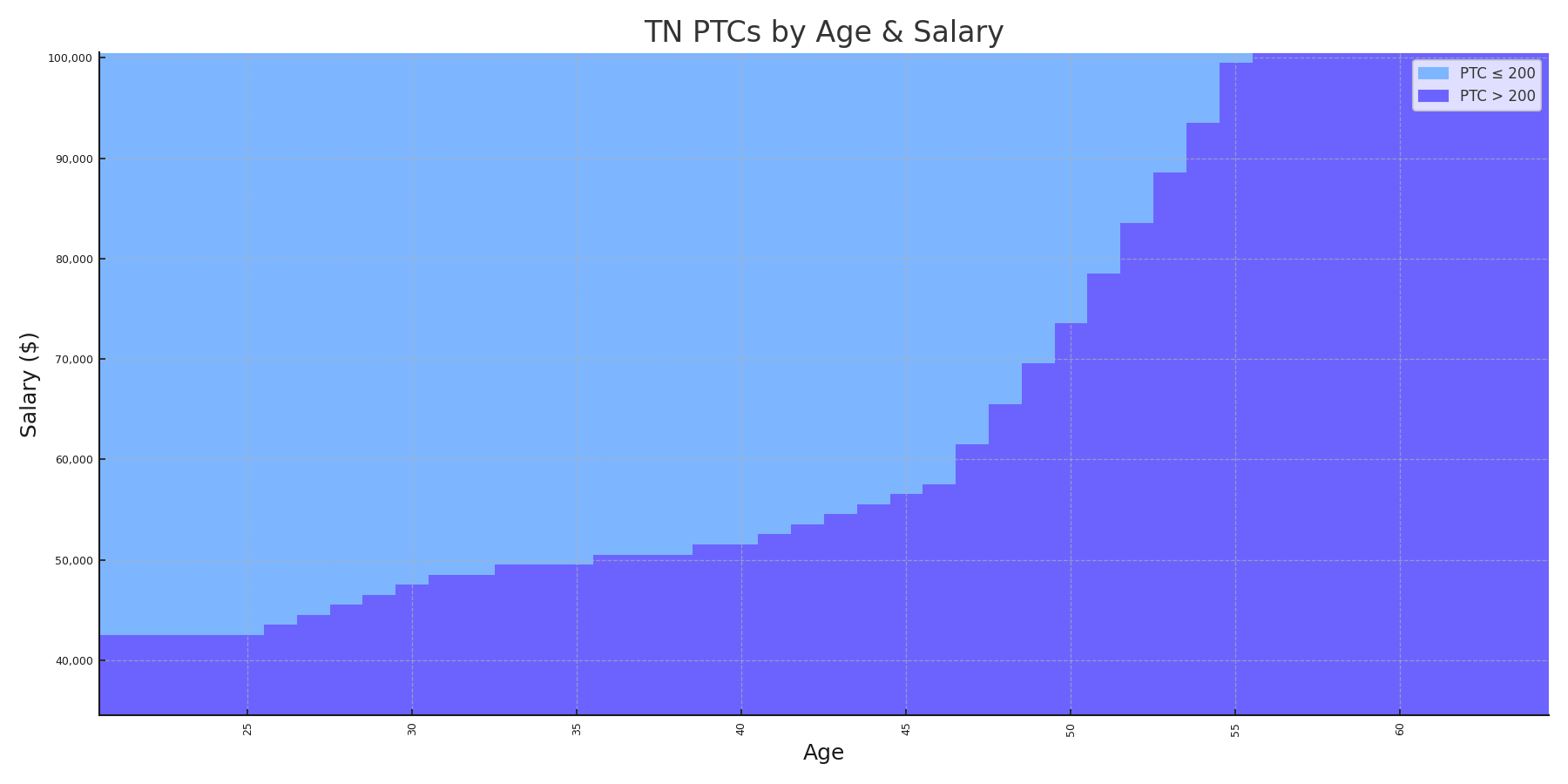

When a company offers affordable coverage—whether through a group plan, an ICHRA, or a QSEHRA—the employee forfeits the credit. If the employer’s benefit isn’t meaningfully higher than the federal subsidy it replaces, neither the business nor the worker comes out ahead. In practice, we’ve found that when most employees qualify for about $200 or more per month in PTCs, an employer-funded plan rarely delivers additional value.

For Tennessee, that $200-mark is reached at roughly $25,000 of wages for a 30-year-old and about $25,000 for a 40-year-old. If most of your team sits above those thresholds, consider skipping an affordable plan—or design an HRA that is affordable for higher-paid staff but intentionally unaffordable for lower-paid or older employees, letting each person keep whichever option (company benefit or federal credit) leaves them better off.

Why HRAs Usually Outperform Small-Group Insurance

For most small employers in Tennessee, reimbursing individual-market premiums through an ICHRA or QSEHRA offers clear advantages over buying a traditional group contract:

- Lower structural cost – Individual carriers must meet an 80 % medical-loss ratio, publish rates, and pay lower commissions; small-group carriers face looser caps and higher commissions, which show up in premiums.

- Employee choice and portability – Each worker selects the network, deductible, and metal tier that fits their situation and keeps the policy when changing jobs.

- Budget control – Employers set a fixed allowance. Marketplace premiums move predictably, avoiding double-digit renewal shocks common in the group market.

- Simpler compliance – HRAs eliminate participation minimums and most COBRA or Form 5500 obligations, and they are just easier to administer.

Run the Numbers for Your Team

Salusion makes it easy to estimate healthcare costs.

Simply enter an employee’s age, zip code, and annual salary into Salusion’s Cost-of-Insurance Calculator, and instantly see average premiums for Bronze, Silver, and Gold individual plans. The calculator also provides an estimated premium tax credit based on the entered household income, and will also tell you whether a proposed HRA allowance is considered affordable for an ICHRA and a QSEHRA.